Call us

Call us

Call us

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Tata AIA Life Insurance Co. Ltd will send you updates on your policy, new products & services, insurance solutions or related information. Select here to opt-in.

Thank you for sharing your details. To receive a call from Tata AIA Financial Advisor.

reCAPTCHA is not working.

No relevant search results found.

Popular searches

Continue from where you left of

The linked insurance product do not offer any liquidity during the first five years of the contract. The policy holder will not be able to surrender/withdraw the monies invested in linked insurance products completely or partially till the end of the fifth year.

When thinking about the future, it is important to make the right financial decisions. TATA AIA Life's Unit Linked Insurance Plans (ULIPs) help you to save for your future and to ensure that your family is protected. This is where a 5-year ULIP can be quite beneficial to you as it offers both life insurance and investment. This plan is ideal for a person who wants to be financially secure and grow his or her wealth in the shortest time..

IN THIS POLICY, THE INVESTMENT RISK IN INVESTMENT PORTFOLIO IS BORNE BY THE POLICYHOLDER

A 5-year ULIP policy is a plan which encompasses two main objectives - insurance and investments. Some of the premium is used for life cover which protects your family. The remainder is invested in funds. It can be equity debt or balanced funds depending on your objectives.

The 5-year period is crucial because this is the holding period. During this period, you are unable to make withdrawals of your money. Hence, the investments that you make also grow without any hindrance. After five years, you can make a partial withdrawal of the funds or continue with the investment in order to accumulate more money.

Another added advantage of investing in ULIPs is that it offers tax benefits under sections 80C and 10(10D) of the IT Act, thus making it all the more effective for planning your financial goals.

Here’s how a ULIP works:

Premium Allocation - In this case, the premium is divided into two components where one offers life coverage while the other is invested in any of the funds that you choose.

Premium Allocation - In this case, the premium is divided into two components where one offers life coverage while the other is invested in any of the funds that you choose. Fund Selection - TATA AIA Life offers a range of funds, including equity for higher returns with more risk and debt for steady, low-risk growth.

Fund Selection - TATA AIA Life offers a range of funds, including equity for higher returns with more risk and debt for steady, low-risk growth. Lock-In Period - A mandatory 5-year lock-in ensures you cannot withdraw funds prematurely, enabling disciplined investment growth.

Lock-In Period - A mandatory 5-year lock-in ensures you cannot withdraw funds prematurely, enabling disciplined investment growth. Market-Linked Growth - The returns depend on the performance of the selected funds. You can switch funds during the policy term to align with market trends.

Market-Linked Growth - The returns depend on the performance of the selected funds. You can switch funds during the policy term to align with market trends. Maturity or Withdrawal Options - After 5 years, you can withdraw funds or remain invested, depending on your financial goals.

Maturity or Withdrawal Options - After 5 years, you can withdraw funds or remain invested, depending on your financial goals.

Opting for a ULIP policy with TATA AIA Life brings a host of benefits:

Dual Benefits: Secure your family’s future with life insurance and grow your wealth simultaneously.

Tax Efficiency: Avail tax benefits on premiums under Section 80C and tax-free maturity benefits under Section 10(10D).

Customised Investments: Choose funds that match your financial goals and risk appetite.

Disciplined Savings: The lock-in period fosters regular investments and financial discipline.

Flexibility: Switch between funds during the policy term and adapt your portfolio to market changes.

Take the case of Rahul, a 35-year-old software professional. Rahul wanted to save for his children’s education while ensuring life cover for his family. He invested ₹12,000 monthly in ULIP policy, allocating funds between equity and balanced options. Over the lock-in period, his investment grew steadily, thanks to market-linked returns.

After 5 years, Rahul had the flexibility to withdraw funds for his children’s school fees or stay invested for greater returns. Along the way, he also saved on taxes, making the policy a win-win solution.

The returns from your TATA AIA ULIP policy depend on several factors:

Returns are influenced by the Net Asset Value (NAV) of the funds, which fluctuates with market trends.

Deductions for premium allocation, fund management, and administration affect the overall return rate.

The fund type (equity, debt, or balanced) you select plays a major role in determining returns.

The reinvestment of earnings during the 5-year period enhances wealth growth.

While 5 years is the lock-in period, staying invested longer often leads to higher returns.

To get an estimate of your investment’s growth, you can use the ULIP Calculator on the TATA AIA website. Simply input details like premium, tenure, and chosen funds to project potential returns.

With our ULIPs, you’re not just investing in financial products - you’re building a secure and prosperous future. Whether you’re planning for milestones like your child’s education or aiming to grow your wealth, TATA AIA’s ULIPs provide the reliability, flexibility, and protection you need

THE LINKED INSURANCE PRODUCT DO NOT OFFER ANY LIQUIDITY DURING THE FIRST FIVE YEARS OF THE CONTRACT. THE POLICY HOLDER WILL NOT BE ABLE TO SURRENDER/WITHDRAW THE MONIES INVESTED IN LINKED INSURANCE PRODUCTS COMPLETELY OR PARTIALLY TILL THE END OF THE FIFTH YEAR.

Past performance is not indicative of future performance.

All investments made by the Company are subject to market risks. The Company does not guarantee any assured returns. The investment income and price may go down as well as up depending on several factors influencing the market.

Please make your own independent decision after consulting your financial or other professional advisor.

Param Raksha Life Pro+ is designed for combination of benefits of following individual and separate products named (1) Tata AIA Smart Sampoorna Raksha Supreme Unit Linked, Non-Participating Individual Life Insurance Plan (UIN: 110L179V01) and (2) Tata AIA Vitality Protect Advance - A Non-Linked, Non- Participating Individual Health Product (UIN: 110N178V01).1 All funds open for new business which have completed 5 years since inception are rated 4 star or 5 star by Morningstar as of August 2024

2©2024 Morningstar. All rights reserved. The Morningstar name is a registered trademark of Morningstar, Inc. in India and other jurisdictions. The information contained here: (1) includes the proprietary information of Morningstar, Inc. and its affiliates, including, without limitation, Morningstar India Private Limited (“Morningstar”); (2) may not be copied, redistributed or used, by any means, in whole or in part, without the prior, written consent of Morningstar; (3) is not warranted to be complete, accurate or timely; and (4) may be drawn from data published on various dates and procured from various sources and (5) shall not be construed as an offer to buy or sell any security or other investment vehicle. Neither Morningstar, Inc. nor any of its affiliates (including, without limitation, Morningstar) nor any of their officers, directors, employees, associates or agents shall be responsible or liable for any trading decisions, damages or other losses resulting directly or indirectly from the information.

10As on 03rd April 2024, the company has a total Assets Under Management (AUM) of Rs.100,099.11 Crores

11Individual Death Claim Settlement Ratio is 99.13% for FY 2023-24 as per the latest annual audited figures.

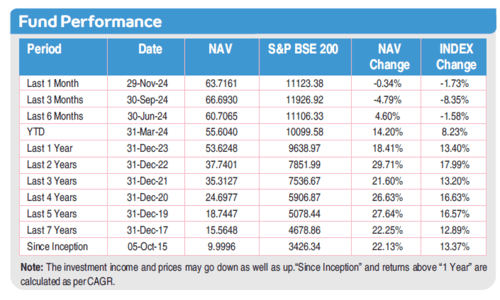

*5-year computed NAV for Multi Cap Fund as of December 2024. Other funds are also available. Benchmark of this fund is S&P BSE 200.

Insurance cover is available under the product.

The products are underwritten by Tata AIA Life Insurance Company Ltd.

The plans are not a guaranteed issuance plan and it will be subject to Company’s underwriting and acceptance.

For more details on risk factors, terms and conditions please read sales brochure carefully before concluding a sale.

Please know the associated risks and the applicable charges, from your Insurance agent or the Intermediary or policy document issued by the insurance company.

Every effort is made to ensure that all information contained in this document is accurate at the date of publication, however, the Tata AIA Life shall not have any liability for any damages of any kind (including but not limited to errors and omissions) whatsoever relating to this material.

Income Tax benefits would be available as per the prevailing income tax laws, subject to fulfilment of conditions stipulated therein. Income Tax laws are subject to change from time to time. Tata AIA Life Insurance Company Ltd. does not assume responsibility on tax implications mentioned anywhere in this document. Please consult your own tax consultant to know the tax benefits available to you.

For ULIP products

The fund is managed by Tata AIA Life Insurance Company Ltd. For more details on risk factors, terms and conditions please read Sales Brochure carefully before concluding a sale. The precise terms and condition of this plan are specified in the Policy Contract.

Past performance is not indicative of future performance. Returns are calculated on an absolute basis for a period of less than (or equal to) a year, with reinvestment of dividends (if any).

Investments are subject to market risks. The Company does not guarantee any assured returns. The investment income and price may go down as well as up depending on several factors influencing the market.

Please make your own independent decision after consulting your financial or other professional advisor.

Tata AIA Life Insurance Company Limited is only the name of the Insurance Company & the Unit linked insurance product with Tata AIA /Tata AIA Life Insurance as its prefix is only the name of the Unit Linked Life Insurance contract and does not in any way indicate the quality of the contract, its future prospects or returns.

Unit Linked Life Insurance products are different from the traditional insurance products and are subject to the risk factors. Please know the associated risks and the applicable charges, from your Insurance Agent or Intermediary or Policy Document issued by the Insurance Company.

Various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns. The underlying Fund's NAV will be affected by interest rates and the performance of the underlying stocks.

The performance of the managed portfolios and funds is not guaranteed, and the value may increase or decrease in accordance with the future experience of the managed portfolios and funds.

Premium paid in the Unit Linked Life Insurance Policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the Insured is responsible for his/her decisions.

Please know the associated risks and the applicable charges, from your insurance agent or the Intermediary or policy document issued by the Insurance Company.

This product is underwritten by Tata AIA Life Insurance Company Ltd.

The plan is not a guaranteed issuance plan, and it will be subject to company’s underwriting and acceptance.

Insurance cover is available under this product.

For more details on risk factors, terms and conditions please read sales brochure carefully before concluding a sale. The precise terms and condition of this plan are specified in the Policy Contract.

Buying a Life Insurance Policy is a long-term commitment. An early termination of the Policy usually involves high costs, and the Surrender Value payable may be less than the all the Premiums Paid.

In case of non-standard lives and on submission of non-standard age proof, extra premiums will be charged as per our underwriting guidelines

L&C/Advt/2025/Mar/1164

New user? Our experts are happy to help.

Thank you for sharing your details.

Our representative will contact you soon.

FOR EXISTING POLICY

FOR EXISTING POLICY

FOR NEW POLICY

FOR NEW POLICY